Simple payback period formula

For example imagine a company invests 200000 in new manufacturing equipment which results in a positive cash flow of 50000 per. The discounted payback period is.

Discounted Payback Period Definition Formula Example Calculator Project Management Info

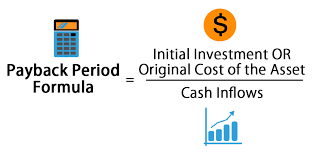

Payback period in capital budgeting refers to the time required to recoup the funds expended in an investment or to reach the break-even point.

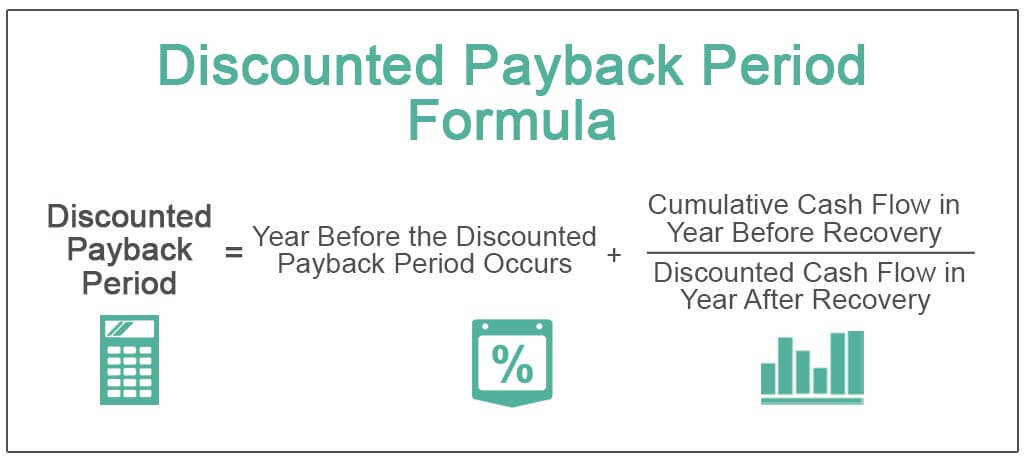

. For example a 1000 investment made at the. The payback period is the total investment required to purchase the asset or fund the project divided by the net annual cash flow which is. The formula for discounted payback period is.

The simple payback period formula is calculated by dividing the cost of the project or investment by its annual cash inflows. Perhaps the simplest method for evaluating the. Hence the total pay-back period will be.

Y is the period that comes after the period where cash flow becomes positive. Calculate Net Cash Flow. Ln 1 discount rate The following is an example.

P is the discounted value of cash flow in the period. How to calculate using the payback period formula. 68 ie the time taken to generate this amount will be 022 years 68308.

Discounted payback period y abs n p. Number of months 3193 819612 around 5 months. The simple payback period formula is calculated by dividing the cost of the project or investment by its annual cash inflows.

To calculate using the payback period formula you can divide the initial cost of a project or investment by the amount. Cash flow per year. Retrieve Last Negative Cash Flow.

As you can see using this payback period calculator you a. Input Data in Excel. Use this formula to calculate the payback period for your capital project or other long-term business investment.

Investment amount discount rate. Find Cash Flow in Next Year. Investment Annual Net Cash Flow From Asset It can get a bit tricky when annual net cash flow is expected to vary from year to year.

The payback period calculation is simple. Discounted Payback Period. 100 20 5 years Discounted.

For example if a company invests 300000 in a new production line and the production line then produces positive cash flow of 100000 per year then the payback period. Now the time taken to recover the balance amount of Rs. The payback formula is simple.

We will need the following number of months from the last period to break even. Payback Period Initial Investment Annual Payback. The simple payback period formula is calculated by dividing the cost of the project or investment by its annual cash inflows.

- ln 1 -. Cost of investment annual cash inflow from the project payback.

Calculate The Payback Period With This Formula

What Is Payback Period Formula Calculation Example

Payback Period Method Commercestudyguide

How To Calculate The Payback Period With Excel

Payback Period Formula And Calculator

Payback Period Formula And Calculator

How To Calculate The Payback Period With Excel

Payback Period Method Double Entry Bookkeeping

Discounted Payback Period Example 1 Youtube

Payback Period Formula And Calculator

Undiscounted Payback Period Discounted Payback Period

How To Calculate The Payback Period With Excel

Payback Period Summary And Forum 12manage

Payback Period Business Tutor2u

B Simple Payback Vs Roi Youtube

Discounted Payback Period Meaning Formula How To Calculate

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube